does maryland have a child tax credit

If you have additional questions regarding the Renters Tax Credit please contact the Departments Renters Tax Credit Program at sd atrentersmarylandgov or 410. The Earned Income Tax Credit EITC is a benefit for working people with low to moderate income.

Irs Child Tax Credit Payments Start July 15

The payments provide 178 million in relief to 400000.

. Maryland provides a deduction for two-income married couples who file a joint income tax return. The tax credits are intended to provide financial relief for low-income parents and their children. If you qualify for the federal earned income tax credit and claim it on your federal.

Taxpayers with federal adjusted gross income of 6000 or less may claim a refundable credit of 500 for each qualifying child generally. Independent Living Tax Credit You may be able to claim a credit towards your state income tax equal to 50 of the incurred expenses to make your home more accessible. Excess credits may be carried over for five 5 years.

For any tax year the sum of all Endow Maryland tax credits including any carryover credits may not exceed the lesser of 50000 or the total amount of tax otherwise payable by the individual andor business for the tax year. Funds contributed to our plans while considered completed gifts for tax purposes are eligible for federal gift tax. To help homeowners deal with large assessment increases on their principal residence state law has established the Homestead Property Tax Credit.

Maryland provides a deduction for two-income married couples who file a joint income tax return. The credit is equal to 50 of the federal tax credit. Maryland Child Tax Credit.

The enhanced child tax credit will help so many families and children in Maryland. Assets in Maryland 529 accounts have estate planning and tax benefits. The Child Tax Credit does not affect your other Federal benefits.

Children must have a Social Security number for families to be eligible to receive. When both you and your spouse have taxable income you may subtract up to 1200 or. The Homestead Credit limits the increase.

The new child tax credit was made fully refundable in 2021 and increased to up to 3600 per year per child through age 5 and up to 3000 per year for children ages 6 to 17. 41756 47646 married filing jointly with one qualifying child. If you qualify for the federal earned income tax credit and claim it on your federal return you may be entitled to a Maryland earned income tax credit on.

When both you and your spouse have taxable income you may subtract up to 1200 or the. It discusses the additional taxpayers eligible to claim the Maryland Earned Income Credit s and the requirements for claiming the Child Tax Credit. The credit is based on your income and a percentage of the care expenses you paid in 2021.

Find answers about advance payments of the 2021 Child Tax Credit. You need to file a 2021 tax return to claim the remaining 2021 Child Tax Credit. Parents who filed taxes in 2019 andor 2020 and meet the income requirements started receiving advance Child Tax Credit payments on July 15 or whenever the money.

Having received monthly Child Tax Credit. This year you can claim up to 8000 paid in care expenses for one qualifying. Does maryland have a child tax credit Monday February 21 2022 Edit.

These updated FAQs were released to the public in Fact Sheet 2022-29PDF May 20 2022. Every child deserves a chance to grow up free from hunger free from poverty and able to. Child Tax Credit 2021 8 Things You Need To Know District Capital Irs Child Tax Credit Payments Start.

15820 21710 married filing jointly with no qualifying children. If we had not processed your 2020 tax return when we determined the amount of your advance Child Tax Credit payment for any month starting July 2021 we estimated the. Last week the Maryland General Assembly passed legislation to expand the state Earned Income Tax Credit EITC to taxpayers using.

The Earned Income Tax Credit also known as Earned Income Credit EIC is a benefit for working people with low to moderate income.

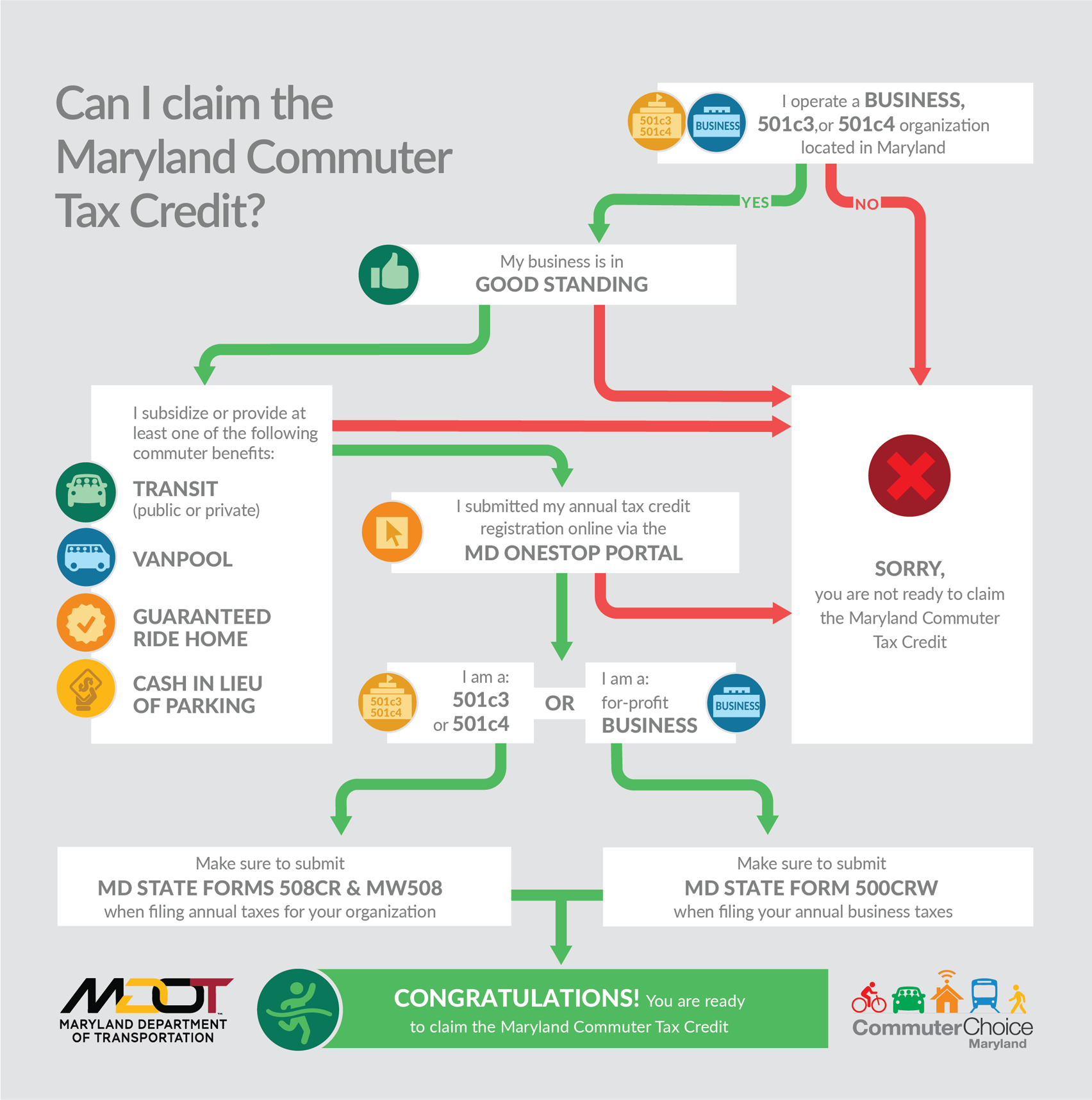

Maryland Commuter Tax Credit Mdot

Maryland Improves Its Child And Dependent Care Tax Credit To Help More Families National Women S Law Center

The Child Tax Credit Payments Are Ending Some Families Say They Will Struggle Without Them The Washington Post

We Solve Tax Problems Tax Debt Irs Taxes Debt Relief Programs

Child Tax Credit Schedule 8812 H R Block

Child Tax Credit 2021 8 Things You Need To Know District Capital

When It Comes To 529s How Good Is Your State S Tax Benefit Morningstar College Savings Plans 529 College Savings Plan Savings Plan

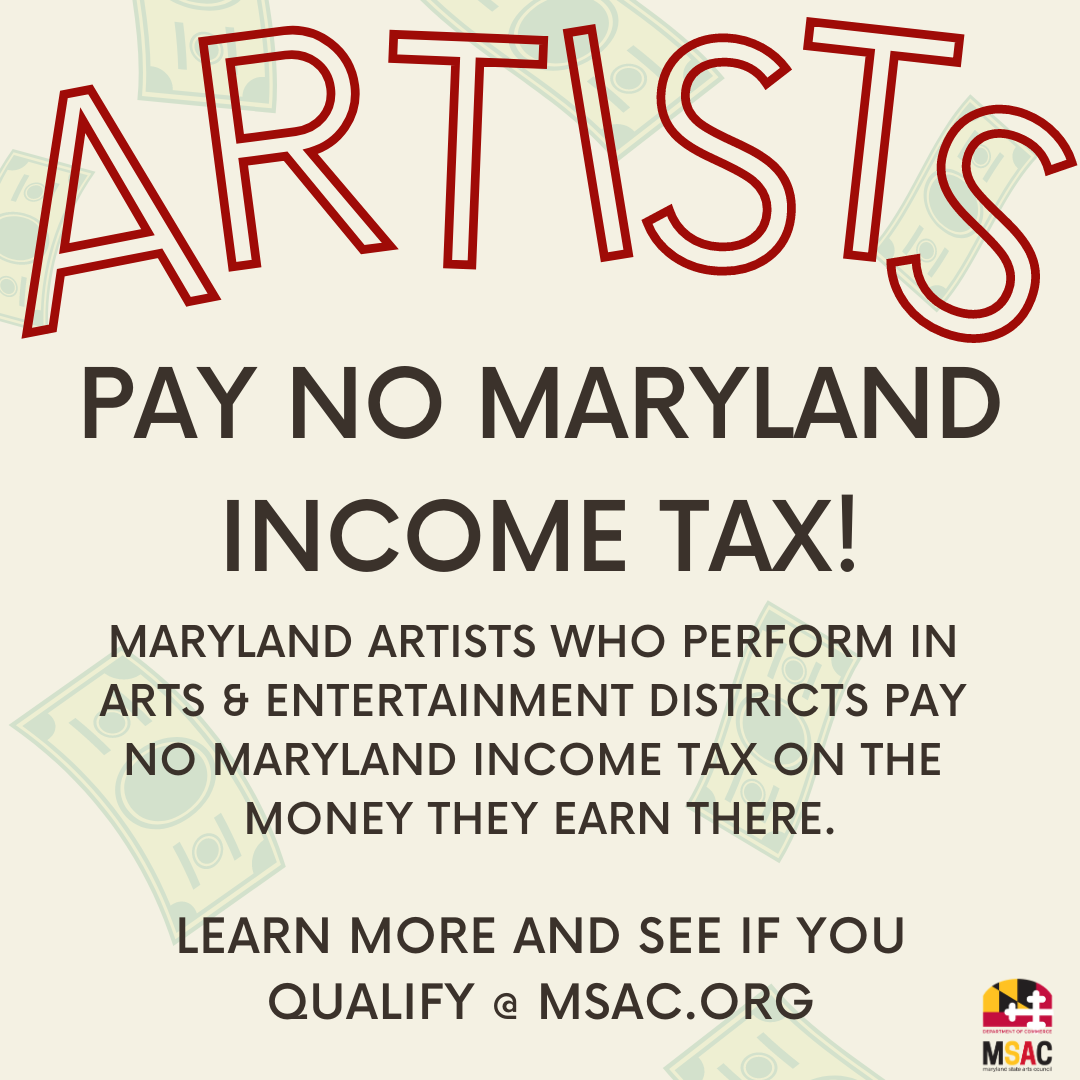

Tax Credit Station North Arts District

Hogan And Legislative Leaders Announce Agreement On Tax Relief 2023 Spending Maryland Matters

Maryland A Southern State Baltimore Frederick Sales Campgrounds Tax Credit Md Page 64 City Data Forum Tax Credits Maryland Southern

Tax Credit Available For Families With Children Dhs News

Tax Credit Available For Families With Children Dhs News

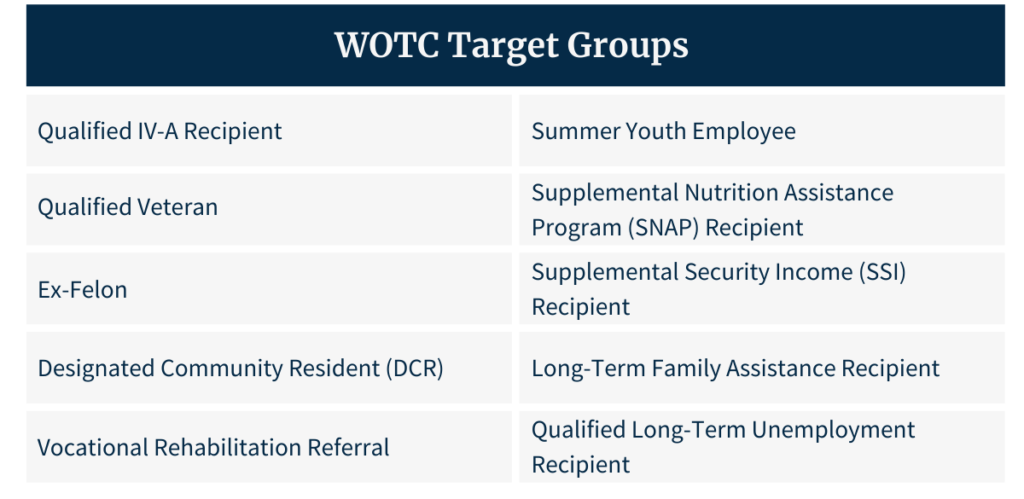

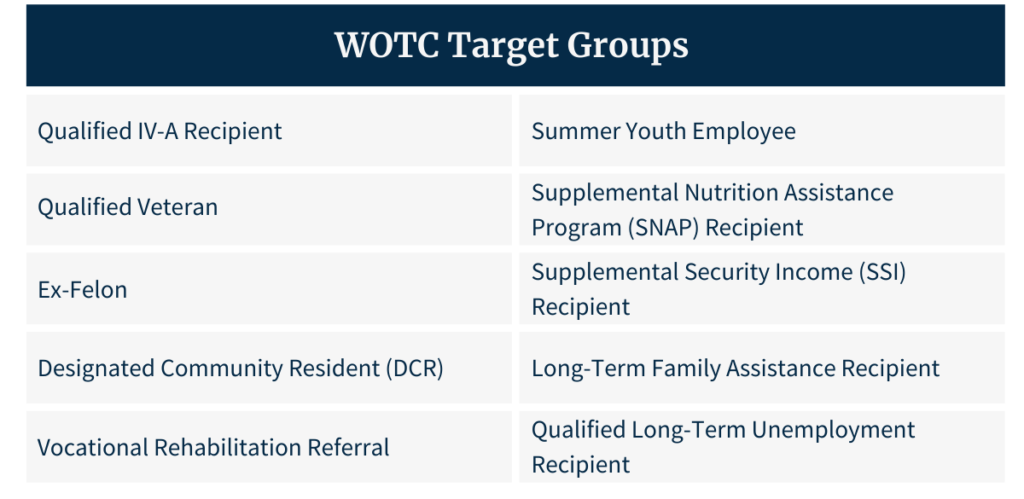

House Leaders Unveil Package To Slash Sales Taxes Expand Federal Work Opportunity Tax Credit Maryland Matters

New 2022 Maryland Tax Relief Legislation Passed Sc H Group

The Last Monthly Child Tax Credit Payments Go Out On Dec 15 The Washington Post

General Assembly Passes 61 Billion Budget As Top Leaders Gather To Sign Tax Breaks Into Law Maryland Matters

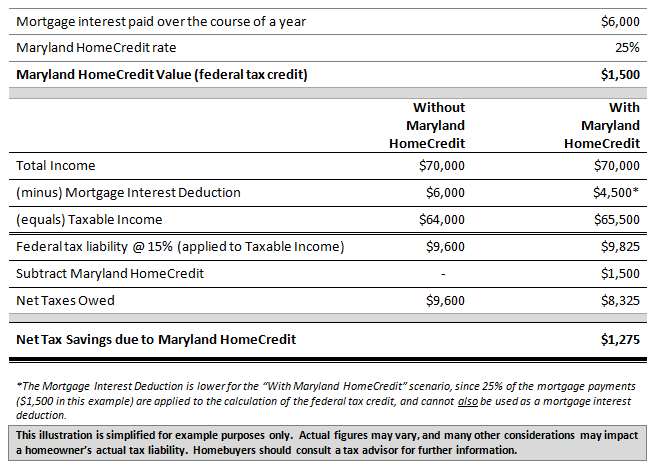

Maryland Homecredit Program Lender Information

Maryland Historical Trust Sustainable Community Street View Historical